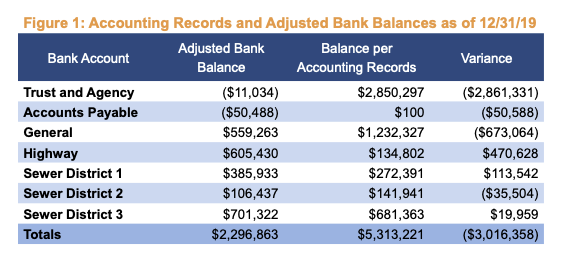

“The Supervisor did not ensure that the Town’s accounting records and reports were complete, accurate, up-to-date or timely. The bookkeeper generally recorded check disbursements in a timely manner. However, during our review of 2019 check registers, we found two exceptions where handwritten checks for workers’ compensation in the amount of $34,022 and a health insurance check in the amount of $21,160 were not recorded in the accounting records. We found revenues were not consistently recorded in the accounting software. For example, collections from October 2019 through December 2019 totaling $590,880 were deposited in the bank but not recorded in the accounting records.

.

.

.

.

The Supervisor did not ensure the bookkeeper performed regular bank reconciliations or ensure an independent review of bank reconciliations was performed by another designated official. We reviewed 91 bank statements4 from January 2019 through January 2020 and found bank accounts were never

reconciled to the accounting records during the 13 months we reviewed. We discussed this with the Supervisor who was unaware that bank reconciliations were not being performed.”

read the entire article

State of New York Comptroller Division of Local Government and School Accountability 5 February 2021.